Paycheck tax calculator 2023

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

2022 Budget Planner Worksheets Free Printable Printables And Inspirations Budget Planner Budgeting Budget Planner Worksheet

Your average tax rate is.

. Over 900000 Businesses Utilize Our Fast Easy Payroll. Try out the take-home calculator choose the 202223 tax year and see how it affects. For 2022-23 the rate of payroll.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Ad Fast Easy Accurate Payroll Tax Systems With ADP. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. On the other hand if you make more than 200000 annually you will pay. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

For example if an employee earns 1500. Calculate Your 2023 Tax Refund. On the first 11800 each employee earns New York employers also pay unemployment insurance of between 0525 and 7825.

FAQ Blog Calculators Students Logbook. Sign Up Today And Join The Team. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Over 900000 Businesses Utilize Our Fast Easy Payroll. The Tax Calculator uses tax. Use this tool to.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. The state tax year is also 12 months but it differs from state to state. 14 days in a bi-weekly pay period.

Some states follow the federal tax. Learn About Payroll Tax Systems. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Other Taxes You Pay Yes. How to calculate annual income.

See where that hard-earned money goes - with UK income tax National Insurance student. It will be updated with 2023 tax year data as soon the data is available from the IRS. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. 2021 Tax Calculator Exit. 2022 Federal income tax withholding calculation.

Ad 4 out of 5 customers reduce payroll errors after switching to Gusto. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. That means that your net pay will be 43041 per year or 3587 per month. Learn About Payroll Tax Systems.

Prepare and e-File your. Calculating Annual Salary Using Bi-Weekly Gross. Due to federally declared disaster in 2017 andor 2018 the.

365 days in the year please use 366 for leap years Formula. Plug in the amount of money youd like to take home. Based on the Information you entered on.

All Services Backed by Tax Guarantee. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Subtract 12900 for Married otherwise. Contact a Taxpert before during or after you prepare and e-File. Sign Up Today And Join The Team.

Estimate your federal income tax withholding. See how your refund take-home pay or tax due are affected by withholding amount. 2022 to 2023 rate.

Prepare and e-File your. New York Unemployment Insurance. Annual Salary Bi-Weekly Gross 14 days.

Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution Ani Globe. It can also be used to help fill steps 3 and 4 of a W-4 form. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

New York State Enacts Tax Increases In Budget Grant Thornton

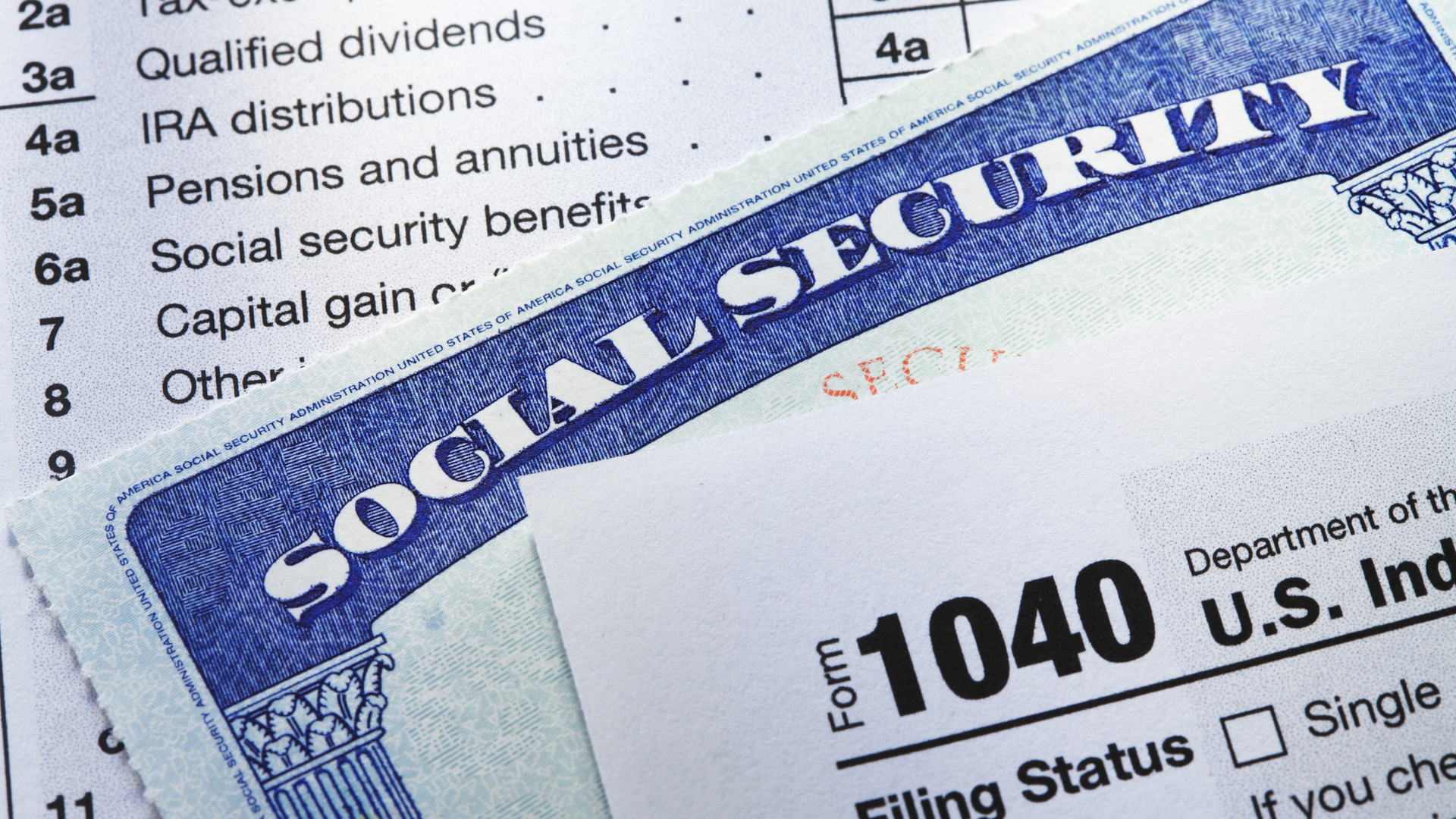

Social Security What Is The Wage Base For 2023 Gobankingrates

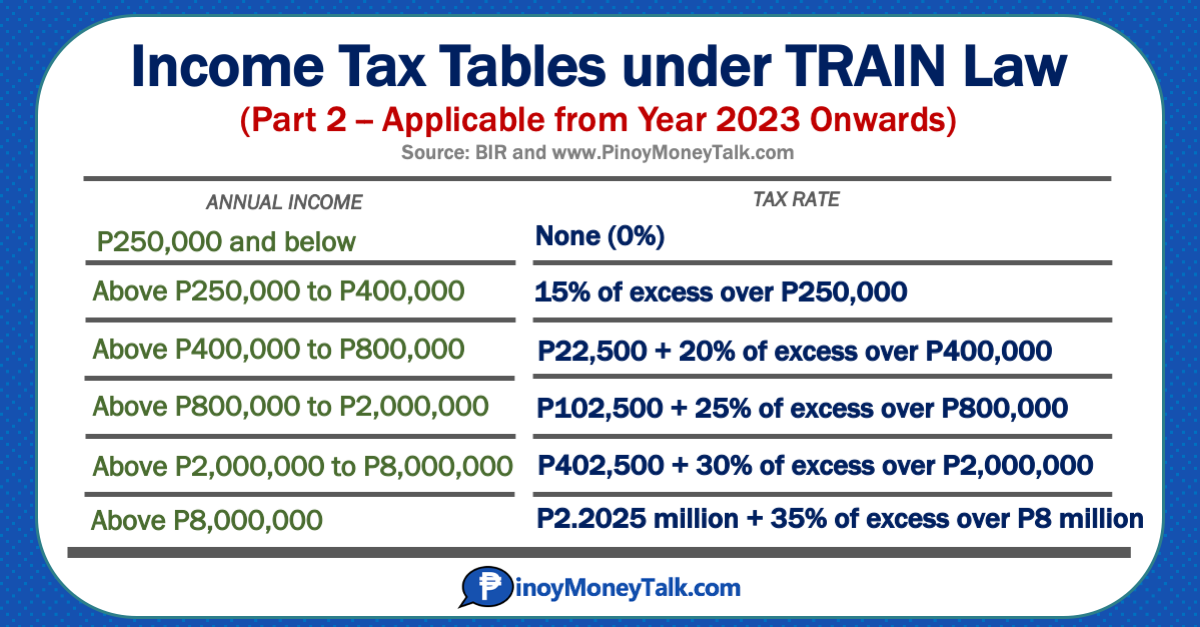

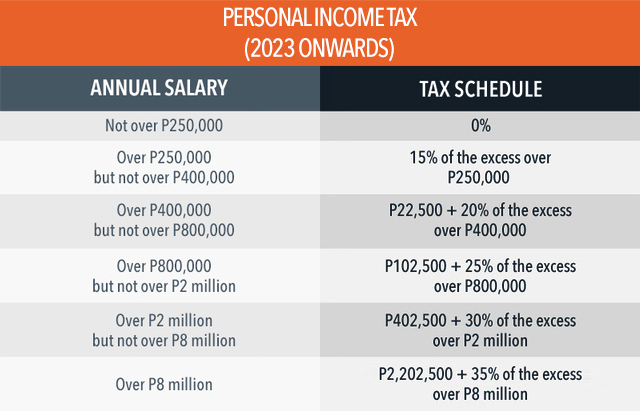

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

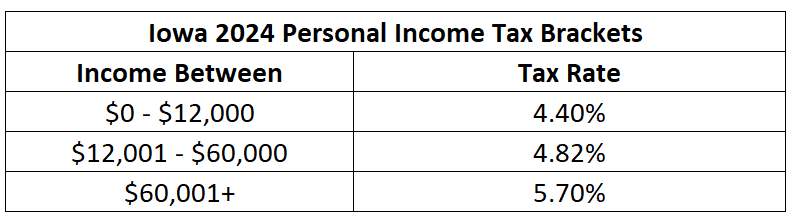

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Tax Calculator Compute Your New Income Tax

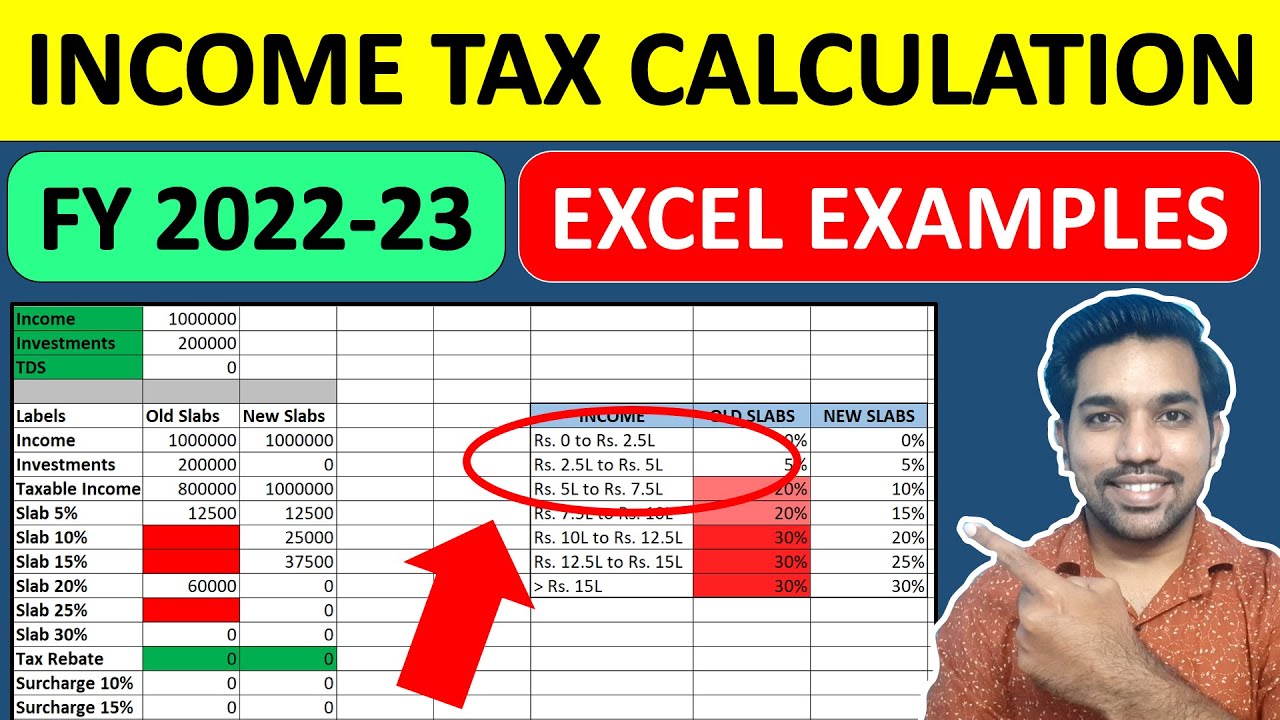

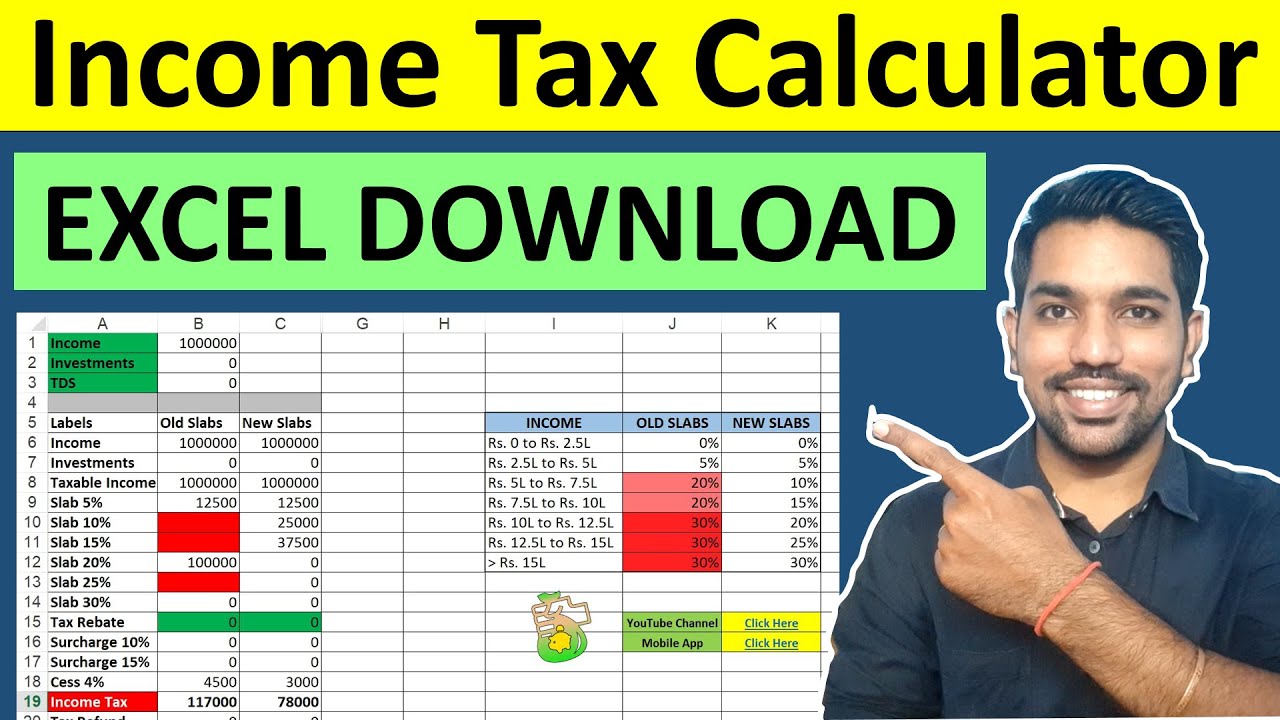

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Free Excel Download Commerceangadi Com

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

2023 W 4 Form Professional Calculator And Pdf Online

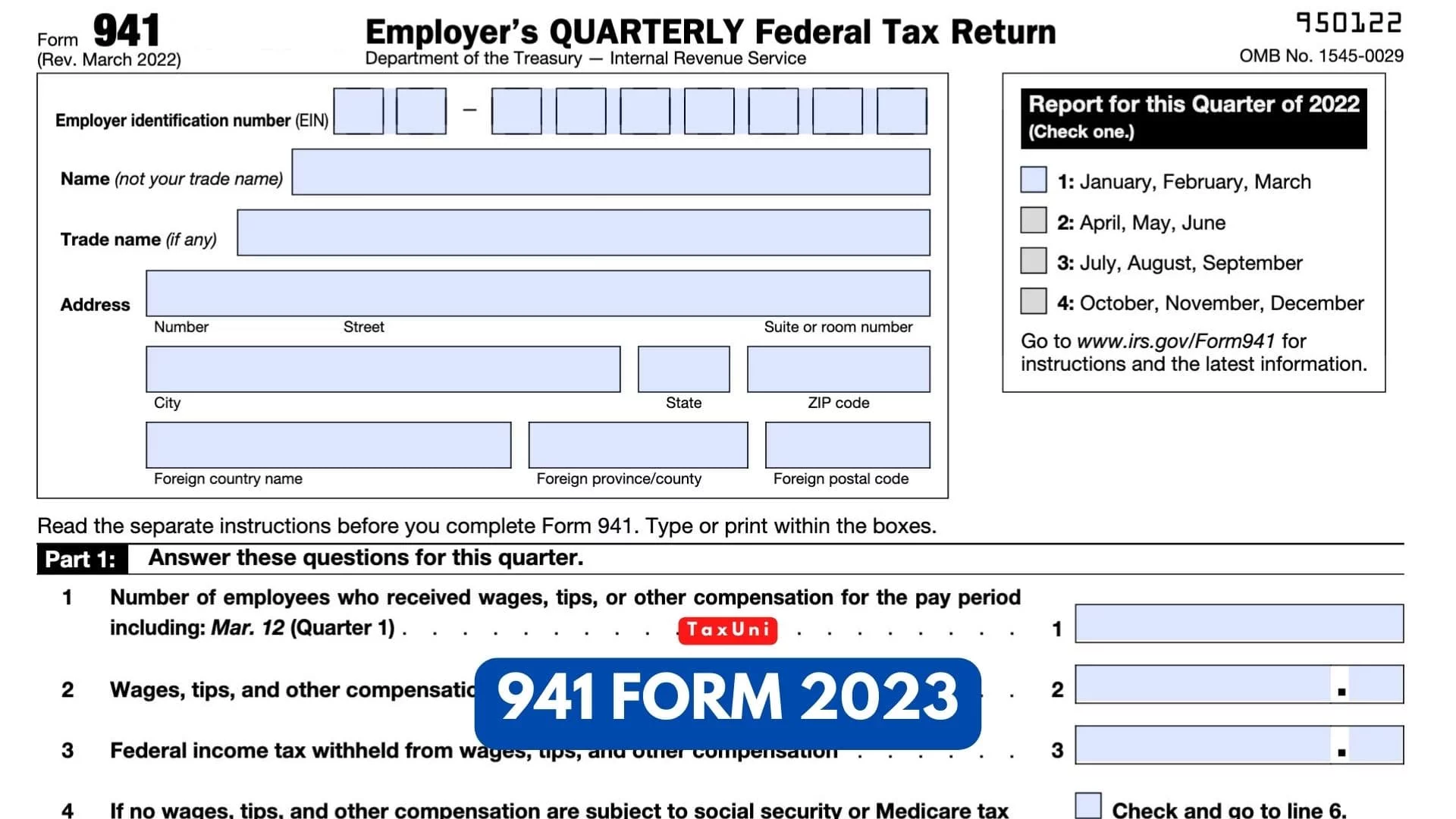

941 Form 2023

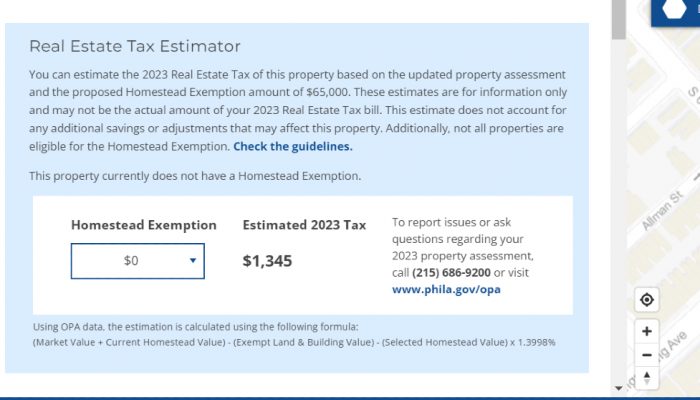

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Estimated Income Tax Payments For 2023 And 2024 Pay Online

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

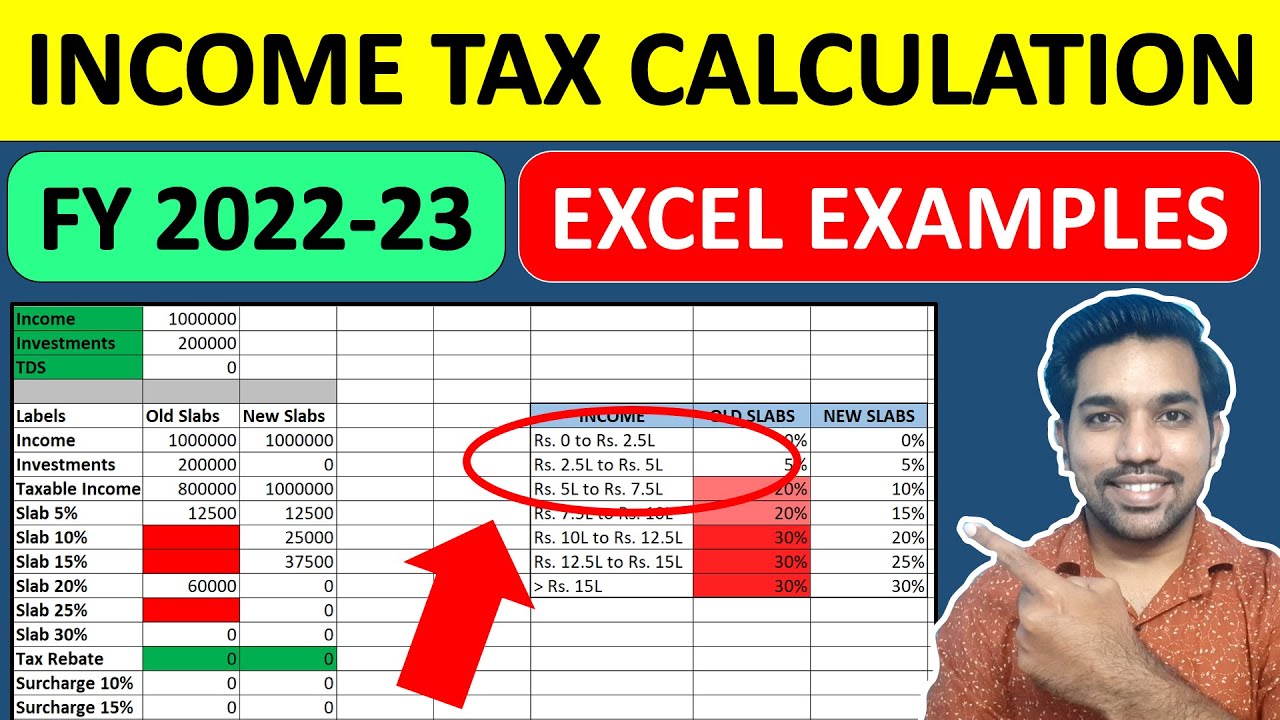

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes